Creating Wealth Real Estate Investing with Jason Hartman

Become an EMPOWERED INVESTOR. Survive and thrive in today's economy! With over 2,000 episodes in this Monday, Wednesday, Friday podcast, business and investment expert Jason Hartman interviews top-tier guests, bestselling authors and financial experts including; Steve Forbes (Freedom Manifesto), Tomas Sowell (Housing Boom and Bust), Noam Chomsky (Manufacturing Consent), Jenny Craig (Health & Fitness CEO), Jim Cramer (Mad Money), Harvey Mackay (Swim With The Sharks & Get Your Foot in the Door), Todd Akin (Former US Congressman), William D. Cohan ( The Price of Silence, The Last Tycoon, & House of Cards), G. Edward Griffin (The Creature from Jekyll Island), Daniel Pink (National Geographic). Starting...

10

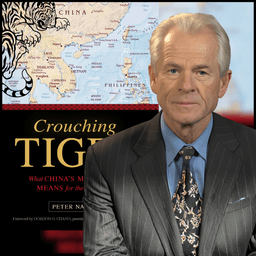

2384 FBF: Dr. Peter Navarro CROUCHING TIGER What Chinas Militarism Means for the World v1

<p>This Flashback Friday is from episode 623, published last January20, 2016.<br /> <br /></p> <p >Is there a safe place to invest your money within the Chinese economy? Jason's guest and author of the new Crouching Tiger book, Dr. Peter Navarro says no. He sees through the beefing up of the Chinese military as a way to distract from the economic failure which is drawing near. China is claiming additional territories and it says it doesn't want conflict with the U.S., but its strained relations with Japan may force the U.S. into defensive mode. Dr. Navarro says he is...

2383: America has a SERIOUS real estate problem with Kevin O'Leary Warns

<p>Jason does a commentary on a video by Kevin O'Leary, who warns of a catastrophic housing crisis driven by a severe supply shortage rather than bad loans. The discussion highlights how median home prices have become disconnected from household incomes, largely due to fluctuating interest rates and the rise of institutional investors buying single-family homes. While the situation creates significant barriers for first-time buyers, the speaker argues that it simultaneously presents a massive opportunity for direct income property investors. Using the Hartman Risk Evaluator, the Jason explains that high construction costs make entry-level housing difficult to build, suggesting that...

2382: Refi Till You Die: The Wealthy Strategy for Real Estate Leverage

<p>Jason and Michael Zuber explore the "refi till you die" real estate investment strategy, which focuses on accumulating wealth through long-term asset ownership rather than selling properties for profit. This approach mimics the financial tactics of the ultra-wealthy by utilizing tax-free borrowed money from refinanced equity to fund one's lifestyle. By leveraging residential real estate, investors can benefit from inflation-induced debt destruction while tenants effectively pay down the mortgages over time. The strategy emphasizes that debt is a powerful tool for wealth extraction because loans are not subject to income or capital gains taxes. Additionally, the discussion highlights the long-term...

2381 FBF: Alvin E. Roth - Who Gets What and Why, The New Economics of Matchmaking & Market Design

<p>This Flashback Friday is from episode 613 published last Dec 29, 2015.</p> <p >Jason ushers us into this episode by taking us through Julie Malinowski's article "6 Trends Among Landlords and Tips to Outperform the Norm". He also reminds us there are a few tickets left to the upcoming Meet the Masters event and about the upcoming Venture Alliance Mastermind in Dubai.</p> <p >In today's guest interview, Alvin E. Roth has written a book about markets. If you are wondering what type of market, as Mr. Roth tells us himself, it's not important what type of market. It's the market itself...

2380: Identifying Priorities on Purpose with Andrew Reichardt

<p>In this 10th episode, Jason discusses the significant impact of fraud on the U.S. financial system and expressed concerns about the slow pace of prosecutions, while highlighting positive developments in real estate investment. He introduced a pro forma analysis strategy for property investments and explained new metrics and tools being developed to assess market conditions and inflationary pressures. Jason also covered the implications of the Genius Act on cryptocurrency and the US dollar, promoting upcoming masterclasses and other membership benefits for investors.</p> <p>Jason then interviews Andrew Reichardt, author of "Priorities on Purpose," who shares his personal...

2379: Money vs. Meaning: Finding Purpose in a World Where Robots Do the Work and Services Cost Nearly Nothing

<p>Jason and Michael Zuber explore how artificial intelligence and humanoid robotics are poised to trigger a massive era of global prosperity. They discuss predictions from tech leaders that automation will soon collapse the cost of services, potentially replacing universal basic income with "universal high income" as living standards rise. While they acknowledge significant job displacement, they argue that human nature will always innovate new desires and industries, such as the growing alternative collectible market. They emphasize that as technology creates more disposable income, the demand for physical real estate and rare assets will likely intensify. Ultimately, they view this transitio...

2378 FBF: Property Acquisition Checklist, Insuring Real Estate Assets with Investment Counselor, Sara

<p>This Flashback Friday is from episode 569, published last September 16, 2015.</p> <p >So you've decided to invest in real estate, what now? Using the checklists provided by Jason and his team you can take things step by step and not miss a thing. Even if this is your first investment you can be certain you are making educated decisions on home inspectors, insurance companies and lenders by using this simple tool. You'll have your real estate portfolio up and growing in no time.</p> <p >Mentions:</p> <p > The Checklist Manifesto </p> <p >Pillar to Post</p> <p >JasonHartman.com</p...

2377: Small Vs. Institutional Investors, the Road to Wealth, Real Estate Markets and Macro Trends

<p>Jason provides an update on the real estate market, emphasizing that property investment remains the primary vehicle for building long-term wealth. He discusses how shifting government policies and potential changes to the Federal Reserve could lead to lower interest rates and increased housing affordability. He highlights specific high-growth markets in the Midwest and Sunbelt while addressing the impact of institutional investors on supply. Jason also introduces technological tools and advisory services designed to help individuals navigate these economic trends. Ultimately, Jason serves as a guide for investors to capitalize on a changing financial landscape and achieve independence through real estate.<...

2376: Trump's Venezuela Strategy & War on Wall Street: Ending Corporate Ownership of Single-Family Homes

<p>This week, Jason and Michael Zuber evaluate President Trump's recent executive actions and their potential consequences for the national housing market and broader economy. They highlights efforts to ban institutional investors from buying single-family homes, a move seen as politically popular but unlikely to trigger a significant price collapse. They also examine the implications of capping credit card interest rates at 10%, debating whether this will help struggling families or inadvertently cause a sharp contraction in available credit. They consider how government-backed mortgage securities and lower interest rates could stimulate housing turnover and GDP growth. Additionally, they cover the subpoena of Feder...

2375 FBF: Doug Hall Promoting Federal Budget Transparency National Priorities Project 2014 Nobel Peace Prize Nominee

<p>This Flashback Friday is from episode 511, published last May 5, 2015.<br /> <br /></p> <p>Jason invites his mother, Sara, Fernando, and Brad to do a mini recap on the Memphis property tour they just had. Fernando shares his property performance statistics to the audience and Brad talks about the Mississippi real estate market. Our guest today is Doug Hall of the National Priorities Project. He talks to Jason on the federal discretionary budget and how his company is trying to make the federal budget more transparent to taxpayers. </p> <p> </p> <p> </p> <p>Follow Jason on TWITTER, INSTAGRAM & LINKEDIN<br...